Life is full of uncertainties, and as Malaysians, we know how important it is to protect our loved ones from financial hardships. Whether you’re a young professional, a parent, or a retiree, life insurance is a crucial tool for securing your family’s future. In this blog post, we’ll explore the top 5 reasons why every Malaysian needs life insurance and how you can get started with the right plan today.

1. Protect Your Family’s Financial Future

Life insurance ensures that your loved ones are financially secure if something unexpected happens to you. For example, if you’re the primary breadwinner, your family may struggle to cover daily expenses, education costs, or mortgage payments without your income. A life insurance policy provides a lump sum payout that can help your family maintain their standard of living.

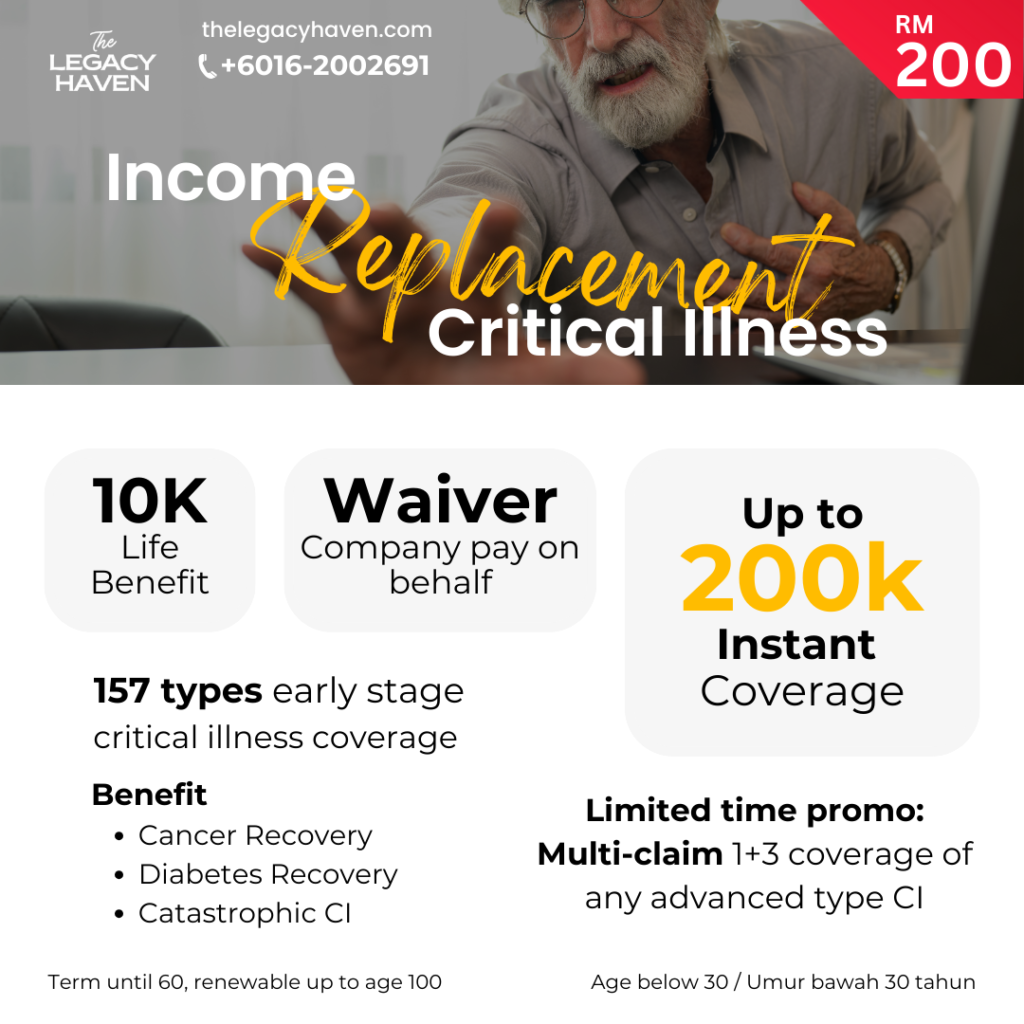

Pro Tip: Consider a policy that covers critical illnesses, as medical expenses can quickly drain savings in Malaysia.

2. Cover Rising Medical Costs

Healthcare costs in Malaysia are increasing every year. Without proper coverage, a single hospitalization or surgery can leave you with a hefty bill. Life insurance policies with medical riders can help cover hospitalization, surgeries, and even post-treatment care, ensuring that you and your family are protected.

Did You Know? According to the Ministry of Health Malaysia, the average cost of hospitalization in private hospitals has risen by 10-15% annually.

3. Secure Your Child’s Education

Education is one of the most significant expenses for Malaysian families. With the rising cost of tuition fees, many parents worry about funding their children’s education. A life insurance policy can include an education fund rider, ensuring that your child’s future is secure, even if you’re no longer around.

Example: A policy with an education rider can provide payouts at key milestones, such as when your child starts university.

4. Leave a Legacy for Your Loved Ones

Life insurance isn’t just about covering expenses—it’s also about leaving a legacy for your loved ones. Whether it’s paying off debts, funding a business, or supporting a charitable cause, a life insurance policy ensures that your wishes are fulfilled.

Storytime: One of my clients used their life insurance payout to start a small business in their spouse’s name, creating a lasting legacy for their family.

5. Peace of Mind for You and Your Family

Perhaps the most significant benefit of life insurance is the peace of mind it brings. Knowing that your family is protected allows you to focus on living life to the fullest. Whether you’re planning for retirement, traveling, or pursuing your passions, life insurance ensures that your loved ones are always taken care of.

How to Get Started with Life Insurance in Malaysia

- Assess Your Needs: Determine how much coverage you need based on your income, expenses, and future goals.

- Compare Policies: Look for a policy that offers comprehensive coverage at an affordable premium. As an Allianz agent, I can help you find the perfect plan.

- Consult a Professional: Speak with a trusted insurance agent (like me!) to understand your options and customize a plan that fits your lifestyle.

Ready to Protect Your Family’s Future?

At The Legacy Haven, we’re committed to helping Malaysians secure their financial future with tailored insurance solutions. Contact me today for a free consultation and take the first step toward peace of mind.

Chat with me today for a free consultation and find the perfect life insurance plan for you! 👉 Click here to get started